Expo

view channel

view channel

view channel

view channel

view channel

view channel

view channel

RadiographyMRIUltrasoundNuclear MedicineGeneral/Advanced ImagingImaging IT

Events

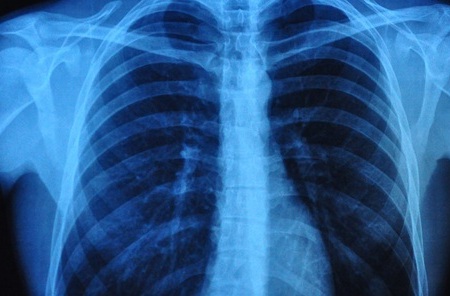

- AI Detects Early Signs of Aging from Chest X-Rays

- X-Ray Breakthrough Captures Three Image-Contrast Types in Single Shot

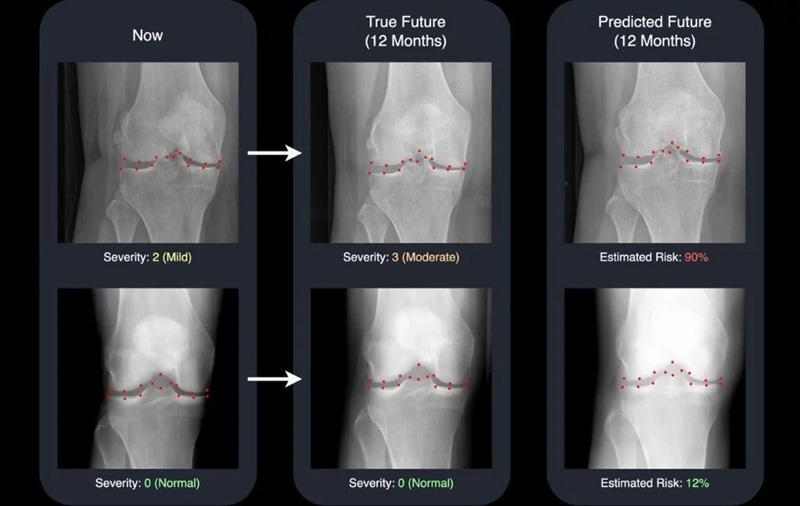

- AI Generates Future Knee X-Rays to Predict Osteoarthritis Progression Risk

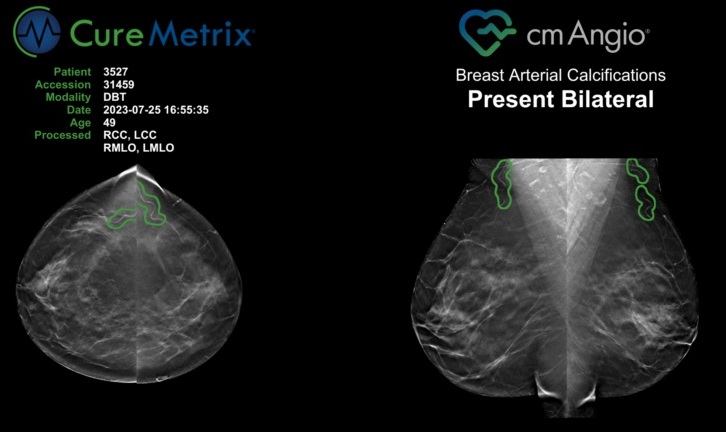

- AI Algorithm Uses Mammograms to Accurately Predict Cardiovascular Risk in Women

- AI Hybrid Strategy Improves Mammogram Interpretation

- MRI Scan Breakthrough to Help Avoid Risky Invasive Tests for Heart Patients

- MRI Scans Reveal Signature Patterns of Brain Activity to Predict Recovery from TBI

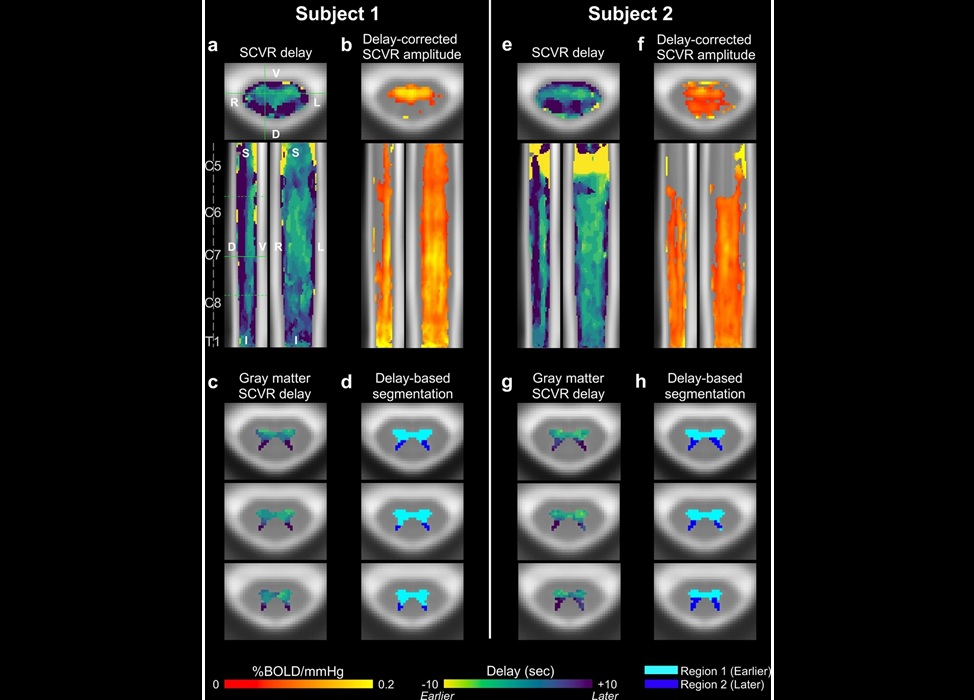

- Novel Imaging Approach to Improve Treatment for Spinal Cord Injuries

- AI-Assisted Model Enhances MRI Heart Scans

- AI Model Outperforms Doctors at Identifying Patients Most At-Risk of Cardiac Arrest

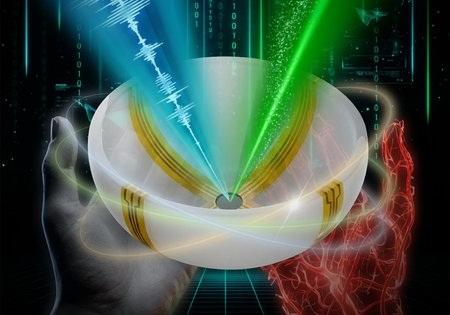

- Cancer “Flashlight” Shows Who Can Benefit from Targeted Treatments

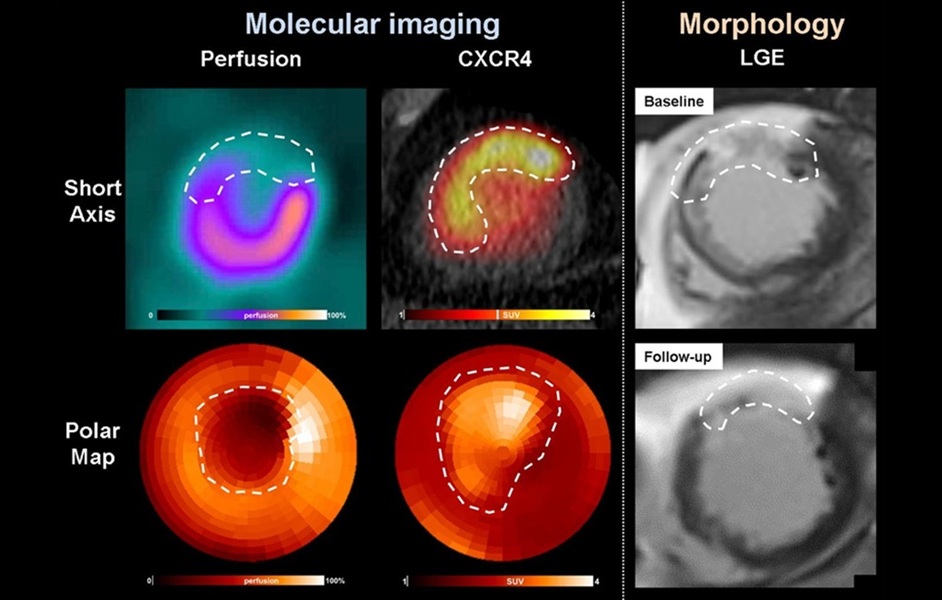

- PET Imaging of Inflammation Predicts Recovery and Guides Therapy After Heart Attack

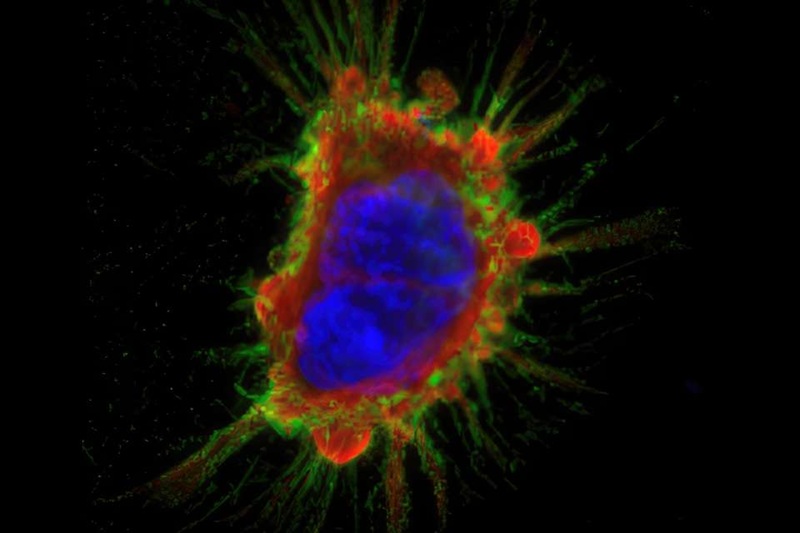

- Radiotheranostic Approach Detects, Kills and Reprograms Aggressive Cancers

- New Imaging Solution Improves Survival for Patients with Recurring Prostate Cancer

- PET Tracer Enables Same-Day Imaging of Triple-Negative Breast and Urothelial Cancers

- Portable Ultrasound Sensor to Enable Earlier Breast Cancer Detection

- Portable Imaging Scanner to Diagnose Lymphatic Disease in Real Time

- Imaging Technique Generates Simultaneous 3D Color Images of Soft-Tissue Structure and Vasculature

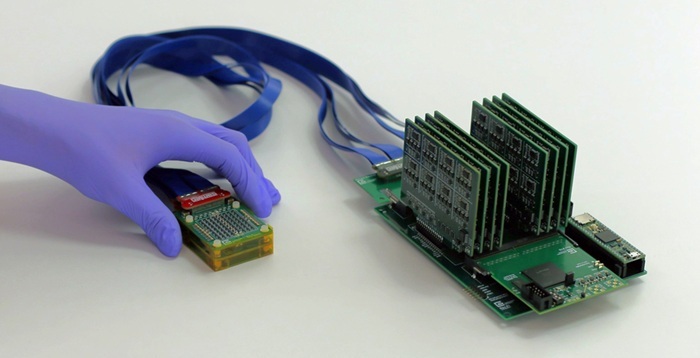

- Wearable Ultrasound Imaging System to Enable Real-Time Disease Monitoring

- Ultrasound Technique Visualizes Deep Blood Vessels in 3D Without Contrast Agents

- New 3D Imaging System Addresses MRI, CT and Ultrasound Limitations

- AI-Based Tool Predicts Future Cardiovascular Events in Angina Patients

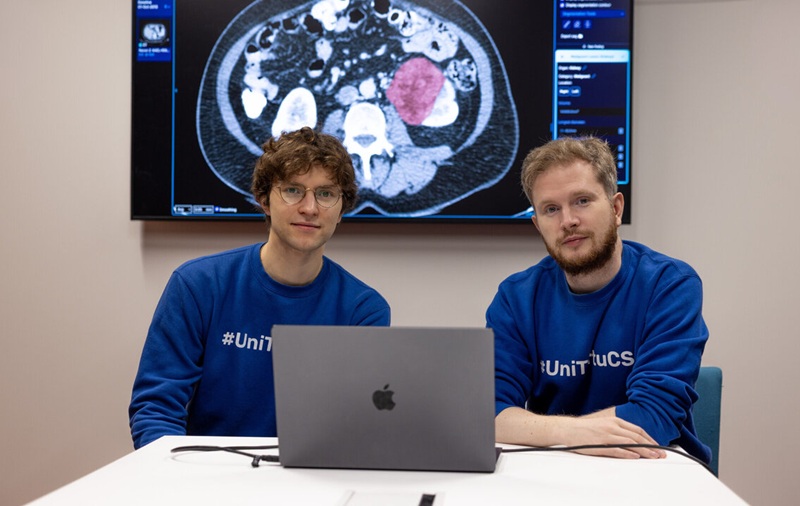

- AI-Based Tool Accelerates Detection of Kidney Cancer

- New Algorithm Dramatically Speeds Up Stroke Detection Scans

- 3D Scanning Approach Enables Ultra-Precise Brain Surgery

- Global AI in Medical Diagnostics Market to Be Driven by Demand for Image Recognition in Radiology

- AI-Based Mammography Triage Software Helps Dramatically Improve Interpretation Process

- Artificial Intelligence (AI) Program Accurately Predicts Lung Cancer Risk from CT Images

- Image Management Platform Streamlines Treatment Plans

- AI Technology for Detecting Breast Cancer Receives CE Mark Approval

- GE HealthCare and NVIDIA Collaboration to Reimagine Diagnostic Imaging

- Patient-Specific 3D-Printed Phantoms Transform CT Imaging

- Siemens and Sectra Collaborate on Enhancing Radiology Workflows

- Bracco Diagnostics and ColoWatch Partner to Expand Availability CRC Screening Tests Using Virtual Colonoscopy

- Mindray Partners with TeleRay to Streamline Ultrasound Delivery

Expo

Expo

- AI Detects Early Signs of Aging from Chest X-Rays

- X-Ray Breakthrough Captures Three Image-Contrast Types in Single Shot

- AI Generates Future Knee X-Rays to Predict Osteoarthritis Progression Risk

- AI Algorithm Uses Mammograms to Accurately Predict Cardiovascular Risk in Women

- AI Hybrid Strategy Improves Mammogram Interpretation

- MRI Scan Breakthrough to Help Avoid Risky Invasive Tests for Heart Patients

- MRI Scans Reveal Signature Patterns of Brain Activity to Predict Recovery from TBI

- Novel Imaging Approach to Improve Treatment for Spinal Cord Injuries

- AI-Assisted Model Enhances MRI Heart Scans

- AI Model Outperforms Doctors at Identifying Patients Most At-Risk of Cardiac Arrest

- Cancer “Flashlight” Shows Who Can Benefit from Targeted Treatments

- PET Imaging of Inflammation Predicts Recovery and Guides Therapy After Heart Attack

- Radiotheranostic Approach Detects, Kills and Reprograms Aggressive Cancers

- New Imaging Solution Improves Survival for Patients with Recurring Prostate Cancer

- PET Tracer Enables Same-Day Imaging of Triple-Negative Breast and Urothelial Cancers

- Portable Ultrasound Sensor to Enable Earlier Breast Cancer Detection

- Portable Imaging Scanner to Diagnose Lymphatic Disease in Real Time

- Imaging Technique Generates Simultaneous 3D Color Images of Soft-Tissue Structure and Vasculature

- Wearable Ultrasound Imaging System to Enable Real-Time Disease Monitoring

- Ultrasound Technique Visualizes Deep Blood Vessels in 3D Without Contrast Agents

- New 3D Imaging System Addresses MRI, CT and Ultrasound Limitations

- AI-Based Tool Predicts Future Cardiovascular Events in Angina Patients

- AI-Based Tool Accelerates Detection of Kidney Cancer

- New Algorithm Dramatically Speeds Up Stroke Detection Scans

- 3D Scanning Approach Enables Ultra-Precise Brain Surgery

- Global AI in Medical Diagnostics Market to Be Driven by Demand for Image Recognition in Radiology

- AI-Based Mammography Triage Software Helps Dramatically Improve Interpretation Process

- Artificial Intelligence (AI) Program Accurately Predicts Lung Cancer Risk from CT Images

- Image Management Platform Streamlines Treatment Plans

- AI Technology for Detecting Breast Cancer Receives CE Mark Approval

- GE HealthCare and NVIDIA Collaboration to Reimagine Diagnostic Imaging

- Patient-Specific 3D-Printed Phantoms Transform CT Imaging

- Siemens and Sectra Collaborate on Enhancing Radiology Workflows

- Bracco Diagnostics and ColoWatch Partner to Expand Availability CRC Screening Tests Using Virtual Colonoscopy

- Mindray Partners with TeleRay to Streamline Ultrasound Delivery